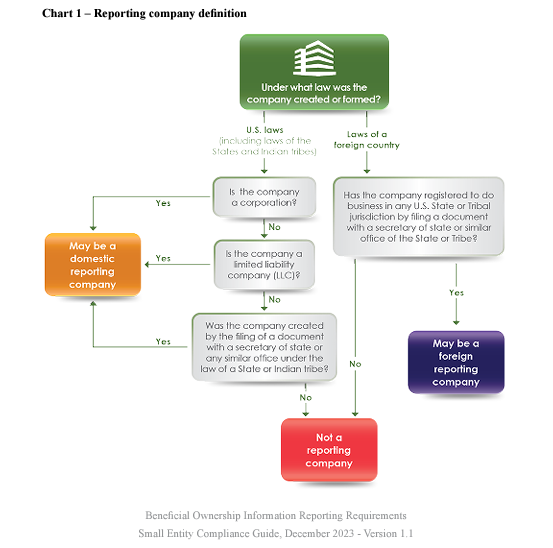

How the Corporate Transparency Act affects your business may depend on the business. The Corporate Transparency Act, went into effect January 2024. This requires small businesses to report information about their business ownership to the government.

What is the Corporate Transparency Act?

The Corporate Transparency Act also known as the CTA was enacted in 2021 to fight illegal activity that might include money laundering, tax fraud, drug trafficking, and financing for terrorism.

Companies are required to disclose information that shows their ownership or control of the company. This beneficial ownership information is submitted to the U.S. Department of Treasury.

The beneficial ownership information reporting is not an annual requirement. It only needs to be submitted one time unless the owner needs to update or to correct information.

You can file at no cost. The steps are simple and secure. But keep in mind there are deadlines.

If your business was created or registered before January 1, 2024 you must file no later than January 1, 2025. If your business was created after January 1st, 2024 you have 90 calendar days to file after receiving actual or public notice that your business registration is effective.

Keep in mind when reporting your company you will need to provide four pieces about each owner.

- name

- date of birth

- address

- the identifying number and issuer from either a non-expired U.S. driver’s license, a non-expired U.S. passport, or a non-expired identification document issued by a State (including a U.S. territory or possession), local government, or Indian tribe. If none of those documents exist, a non-expired foreign passport can be used. An image of the document must also be submitted.

How the Corporate Transparency Act affects your business will depends on a few things. To get the step by step instructions visit by clicking the compliance guide.